The Earned Revenue Toolkit

Insights, inspiration, and tools— co-designed by NorthStar Education Partners and Transcend—to support model sharers in their financial sustainability journey.

Unlock Sustainable, Mission-Driven Revenue

For model sharers, the pursuit of financial sustainability isn’t just about staying afloat—it’s about creating the freedom to increase impact, innovate boldly, and build long-term financial stability. Earned revenue—income generated through services, products, or partnerships—offers a powerful pathway toward that freedom, enabling organizations to reduce reliance on volatile funding streams and reinvest in their mission.

This resource equips you with actionable strategies to develop earned revenue streams, showcases real-world examples from model sharers who are building financial sustainability, and provides starter tools to help you launch or refine your own revenue strategy.

Let’s make the shift to Mission-Aligned Earned Revenue

Get Started

Not sure where to start? Take our 5 minute diagnostic

Financial Sustainability Primer

What is financial sustainability?

✅ What it is

The ability to consistently generate revenue that covers expenses, builds reserves, and fuels impact—all while staying true to your mission and values. It’s a strategic approach to managing resources that ensures long-term impact and resilience.

❌ What it isn’t

It’s not just about surviving or covering the basics. It’s not relying solely on unpredictable grants, squeezing programs to cut costs, or compromising your mission for funding. Financial sustainability is about building intentional, adaptable revenue streams that allow your organization to thrive.

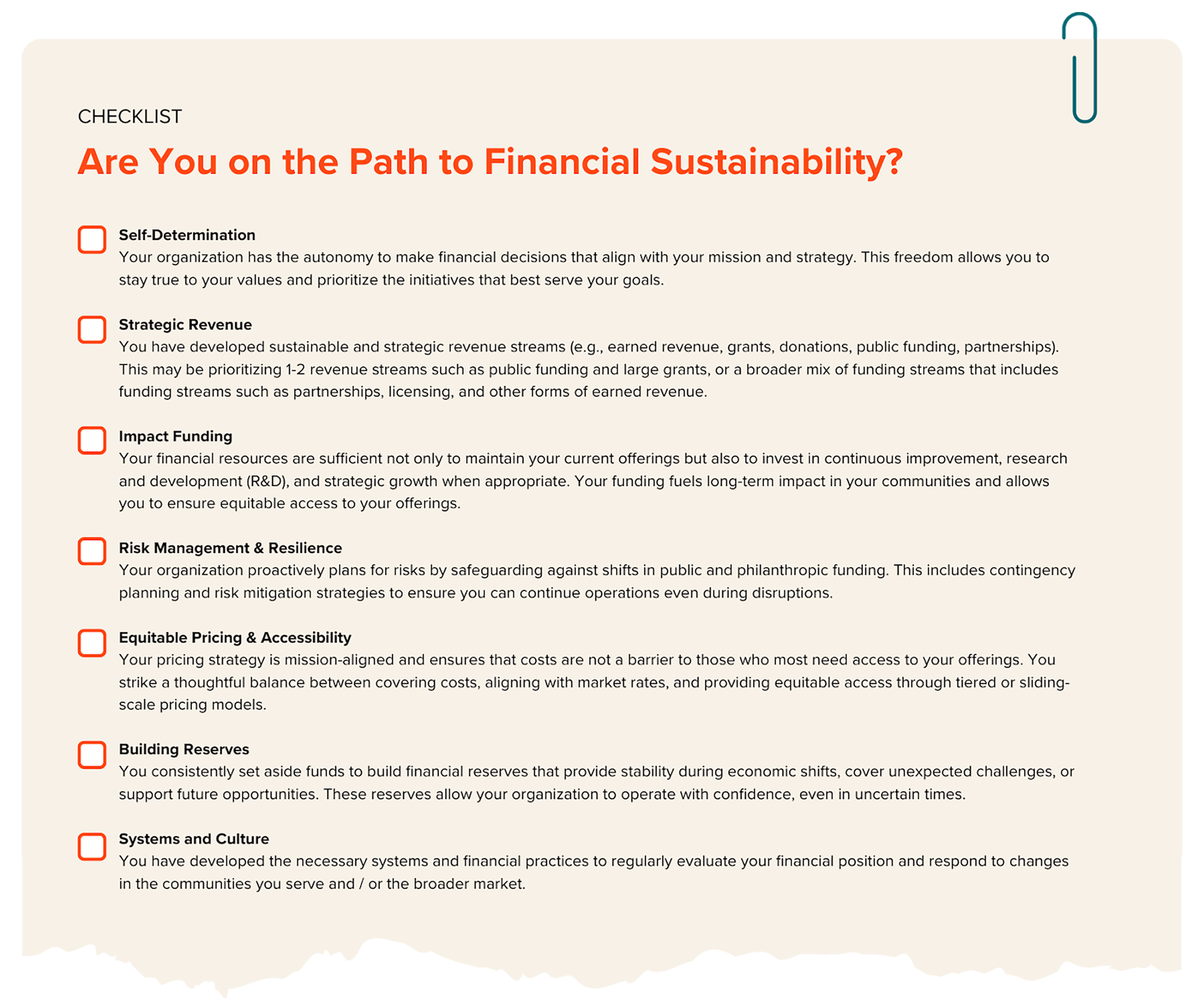

Model sharers take different approaches to achieving financial sustainability. Here are several indicators that signal you’re on the right path.

What are the key steps to generating earned revenue?

Key Step

🧠 Cultivate the Right Mindset and Build Transparency Around Finances

Conversations about revenue can be uncomfortable, especially when personal or cultural discomfort with money intersects with a lack of open financial dialogue. Foster a culture where financial sustainability is seen as essential to fueling your mission, where staff understands financial conditions, has access to relevant data, and builds skills to incorporate finances into programming and budget decisions.

Action Items

- Facilitate discussions on staff cultural and historical views around money and align on organizational values for earned revenue, with an emphasis on equity and access.

- Read the case studies to study different pathways to financial sustainability.

- Craft your financial sustainability vision statement with your team.

- Incorporate financial sustainability into conversations about designing and delivering your offering.

Key Step

🛠 Design Impactful, Value-Generating Offerings

Earned revenue strategies will fail if your offerings don’t meet the unmet needs of the communities you serve. Focus on solutions that align with your mission and deliver high impact as an essential precursor to launching a full-blown earned revenue strategy.

Action Items

- Listen closely to the communities you serve to align offerings with their needs.

- Use the Offering Model Whiteboard Template to develop your offering vision and ensure it is designed with financial sustainability in mind.

- Pilot offerings through small projects and evaluate impact—informally or formally—before scaling.

Key Step

✅ Determine Which Offerings to Start, Stop, or Scale

Conversations about revenue can be uncomfortable, especially when personal or cultural discomfort with money intersects with a lack of open financial dialogue. Foster a culture where financial sustainability is seen as essential to fueling your mission, where staff understands financial conditions, has access to relevant data, and builds skills to incorporate finances into programming and budget decisions.

Action Items

- Plot all current offerings on Bridgespan’s 2x2 matrix to evaluate impact and earned revenue. Use these tools to guide next steps:📄 Read the article📝 Download the guide and Excel template📽 Watch an introductory video

- Use the Readiness Criteria Rubric to align your team on readiness to launch offerings.

- Build staff capacity to market, communicate, deliver, and evaluate offerings effectively.

Key Step

💡 Select the Right Revenue Pathways and Build Demand

Explore revenue pathways—such as partnerships, licensing, joint ventures, or coaching—that align with your offerings, mission, and financial sustainability vision. Build demand by showcasing your impact and reaching your audience through targeted strategies.

Action Items

- Explore Earned Revenue Strategies to identify creative ways to monetize existing offerings in alignment with your mission.

- Use the Offering Model Whiteboard Template to develop your offering vision and ensure it is designed with financial sustainability in mind.

- Create demand by:

- Developing proof points of impact (e.g., case studies, testimonials)

- Tuning marketing strategies to show how your offering solves key problems

- Publishing webinars, white papers, and op-eds to raise awareness

- Expanding channels through email, social media, referrals, and partnerships

What are the 5 common hurdles model sharers face when pursuing earned revenue?

Pursuing earned revenue can be a key strategy for financial sustainability, but it's not without its challenges. Here are some of the primary hurdles that model sharers often encounter, along with what it might sound like from staff experiencing the hurdle.

1. Shifting Mindset and Culture

One major hurdle is the organization's mindset around money. Discussions about fundraising or earned revenue can feel uncomfortable, particularly if team members carry personal or cultural histories related to money. Shifting the narrative from "asking for money" to "inviting others to invest in a shared vision" is a crucial cultural shift that takes time and intention to cultivate across your team.

"There’s a deep emotional weight for folks of color around money—it’s not just financial, it's personal. We hold the tension of carrying this history and trauma around wealth disparities, which can make it hard to step into fundraising and connect with those holding the resources. And then there’s the added tension of charging for support that feels like it should be free; it feels like putting a price tag on something meant to be shared. Balancing that is really difficult."

— Early-stage model sharer

2. Creating Impactful, Value-Generating Services

Financial sustainability hinges on delivering high-impact offerings that truly meet the needs of the communities served. However, moving too quickly to monetize services before fully codifying them can create stress, distractions, and ultimately lead to a lack of demand. It's essential to focus on understanding stakeholder needs and refining your offerings to ensure they drive value.

"We rushed to start selling our services because we thought it would bring in revenue quickly, but we hadn’t really nailed down the core offering yet. It wasn’t fully codified or tested for impact, and we ended up spreading ourselves thin—chasing revenue without a clear plan. It created more distractions and stress than it was worth."

— Early-stage model sharer

3. Raising Awareness and Generating Demand

Even with impactful and well-designed offerings, some model sharers struggle to gain traction in the marketplace. A strong value proposition is necessary to break through the status quo, especially in the education sector, where stakeholders often lean toward familiar practices. The challenge is not only proving impact but also communicating value and creating urgency for adoption.

"We have this incredible model that’s been proven to work, but getting schools to see the value and scale it has been an uphill battle. It’s frustrating because we know the impact it can have, but the field either doesn’t understand it or simply doesn’t know it exists. It’s hard to grow when there’s no real demand."

— Program director of a scaling model sharer

4. Designing offerings for financial sustainability

A lack of alignment between mission, programmatic goals, and financial strategy can lead to inefficiencies. Sometimes, model sharers customize every offering to meet the specific needs of each school or partner, without a clear understanding of the associated costs. This can result in offerings operating at a financial loss—sustainable in a startup phase but challenging as the organization matures and faces shifts in philanthropy.

"We customize everything to meet our schools' needs, but that makes our offerings wildly inefficient. When we calculate the true costs—time, travel, one-off planning meetings—we’re actually losing 2x-3x of the revenue we bring in. That was fine when we were in startup mode, but it’s just not sustainable anymore given the shifts we’re seeing in philanthropy."

— COO of a growing model sharer

5. Aligning Pricing with Value

Many model sharers face challenges in setting prices that truly reflect the value and impact of their offerings. In some cases, valuable offerings are underpriced relative to the benefits they deliver and to market rates, resulting in lost revenue opportunities. In other cases, newer offerings that haven’t yet demonstrated significant value may be priced too high, creating barriers to initial adoption and limiting market testing. Additional challenges include inconsistent pricing across similar offerings and failing to update pricing in response to shifts in market demand or changing conditions. Addressing these issues is essential for achieving financial sustainability and ensuring offerings are accessible, valued, and effective.

"After we adjusted our pricing to better match the true value of our services, we saw an immediate shift in demand and appreciation from our partners. It was clear that aligning our prices with impact created both financial and relational benefits."— Executive Director of a growing model sharer

Explore Earned Revenue Pathways

Model sharers pursue unique visions for financial sustainability, often taking creative—and sometimes tough—steps to get there. From cutting ineffective programs to shifting from custom services to streamlined, scalable offerings, each journey reflects hard-earned lessons.

The case studies below, inspired by real model sharer experiences, offer insights and inspiration. Dive in to see how different organizations made bold pivots, optimized services, and built new revenue streams in pursuit of their sustainability goals.

Revenue through refinement

Key Actions:

- Streamlined services by codifying training materials and toolkits to reduce delivery time

- Lowered delivery costs by shifting to virtual formats

- Developed templates and standardized offerings to increase scalability

- Paused cohort programs focused on curriculum implementation with academic leaders in urban districts due to variable impact and declining enrollment/referrals

- Partnered with national organizations to grow and scale their reach

Earned Revenue Journey:

National Instruction & Curriculum Implementation Support Organization

Founded: 2018

Financial Sustainability Vision:

By 2030, 70% of our organization’s expenses will be covered by sustained earned revenue, giving us the freedom to pursue initiatives that best serve our communities. The remaining 30% will come from multi-year grants for R&D and piloting new offerings.

Key Actions by Year:

- Year 1 (2018): Launched pilot programs focusing on curriculum implementation with academic leaders in three urban districts, funded by $500K in grants. Published a white paper to build awareness and position the organization in the field.

- Year 2 (2019): Introduced leadership cohorts at $2,500 per participant but faced declining enrollment and variable impact. Offered 30% discounts and free consultations to attract partners but saw limited results.

- Year 3 (2020): Paused the cohort model after conducting an audit of design and delivery time. Found that staff time and expenses exceeded revenue by 60%, resulting in operating the program at a loss. This led the organization to streamline services by codifying key trainings and templates to reduce delivery time and effort.

- Year 4 (2021): Shifted services to virtual delivery, reducing travel costs. Developed standardized templates and toolkits to ensure faster and more consistent delivery. These efforts led to a 25% profit margin across all programming.

- Year 5 (2022): Partnered with a national superintendent’s association, resulting in doubling the number of districts served and expanding into new geographies. Professional development (PD) was offered at $8,500 per session, and by year-end, earned revenue covered 50% of expenses.

Strategic Pivots

Key Actions:

- Discontinued low-demand services to focus on higher-impact offerings

- Redesigned core consulting model to emphasize value and impact

- Shifted pricing structure based on market insights and feedback

- Introduced licensed tools, surveys, and a benchmarking platform to generate scalable revenue

Earned Revenue Journey:

Regional Student Well-Being and SEL Consulting Organization

Founded: 2020

Financial Sustainability Vision:

By 2028, our financial model will achieve a 50/50 split between earned revenue and philanthropic support. Corporate and foundation grants will fund R&D and innovation, while consulting, coaching, and digital tools sustain core operations.

Key Actions by Year:

- Year 1 (2020): Piloted SEL programs in five schools with a $300K grant. Published a landscape scan paper summarizing key trends in SEL and identifying gaps in curriculum and implementation to raise awareness of the impact and need for SEL.

- Year 2 (2021): Launched SEL workshops at $3,000 per session and coaching at $150/hour. Introduced free webinars and 30-minute consulting sessions to attract potential partners.

- Year 3 (2022): Shifted to licensed SEL content that included curriculum, walk-through observation tools, and project-based SEL tasks aligned to Common Core standards. Discontinued low-demand coaching packages to focus on more scalable offerings. Launched a web-based platform that allowed districts to benchmark their SEL survey results against national results, expanding the value proposition.

- Year 4 (2023): Hired seasoned SEL coaches capable of delivering services at $250/hour, significantly increasing the value of consulting engagements. Streamlined workshops and consulting services to align with the most requested offerings.

Strategic Pricing

Key Actions:

- Developed a sliding-scale pricing model to increase access for under-resourced schools

- Surveyed stakeholders to assess impact and willingness to pay

- Shifted focus to higher-value school partnerships for more predictable revenue

- Increased pricing for high-demand services based on demand analysis

- Targeted small charter networks and rural high schools to expand reach

Earned Revenue Journey:

College Access & Career Pathways Nonprofit Serving Communities

Founded: 2017

Financial Sustainability Vision:

By 2027, 60% of our operating costs will be funded through earned revenue from coaching, workshops, and school partnerships. The remaining 40% will come from public funding and individual donations to ensure equitable access for students.

Key Actions by Year:

- Year 1 (2017): Launched free college workshops with $400K in grants. Partnered with local businesses to host events, but struggled to convert participants into paying clients.

- Year 2 (2018): Introduced career coaching at $100/hour, but demand was low. Conducted a survey of stakeholders to gauge the value of services and assess willingness to pay. Based on feedback, shifted focus to school partnerships at $7,500/year for more consistent revenue.

- Year 3 (2019): Launched a membership model offering unlimited workshops and coaching at $25K/year but failed to attract enough partners. Used survey insights to adjust the pricing model and refine service offerings.

- Year 4 (2020): Developed a sliding-scale pricing model targeting under-resourced schools. Focused outreach on small charter networks and single-site high schools in rural areas that could not afford traditional college access programming. Earned revenue covered 20% of expenses.

- Year 5 (2021): Increased rates for high-demand services and used CRM tracking to deepen relationships, moving existing partners into higher-tier offerings.

Explore 20+ Earned Revenue Strategies

Unlock new possibilities for generating mission-aligned revenue with this curated database of innovative strategies. Push beyond traditional models and find ideas that align with your mission and financial sustainability goals

What’s inside:

-

Inspiration beyond coaching, cohorts and consulting

Explore creative revenue models such as affiliate marketing, licensing, membership programs, and technology platforms.

-

Pricing strategies

Access ideas for pricing your offerings

-

Analysis of revenue-generating strategies

Review pros, cons, and strategic fit to assess whether a strategy aligns with your mission and determine if it’s worth pursuing.

Ready to explore? Jump in and discover strategies that spark new revenue streams for your organization!

Templates and Tools to Build Financial

Sustainability

Financial Shifts Presentation

Financial Model

Readiness Criteria Rubric

Offering Model Whiteboard

Financial Sustainability Vision Template

Resource Filters

Making the Shift Towards Financial

Sustainability

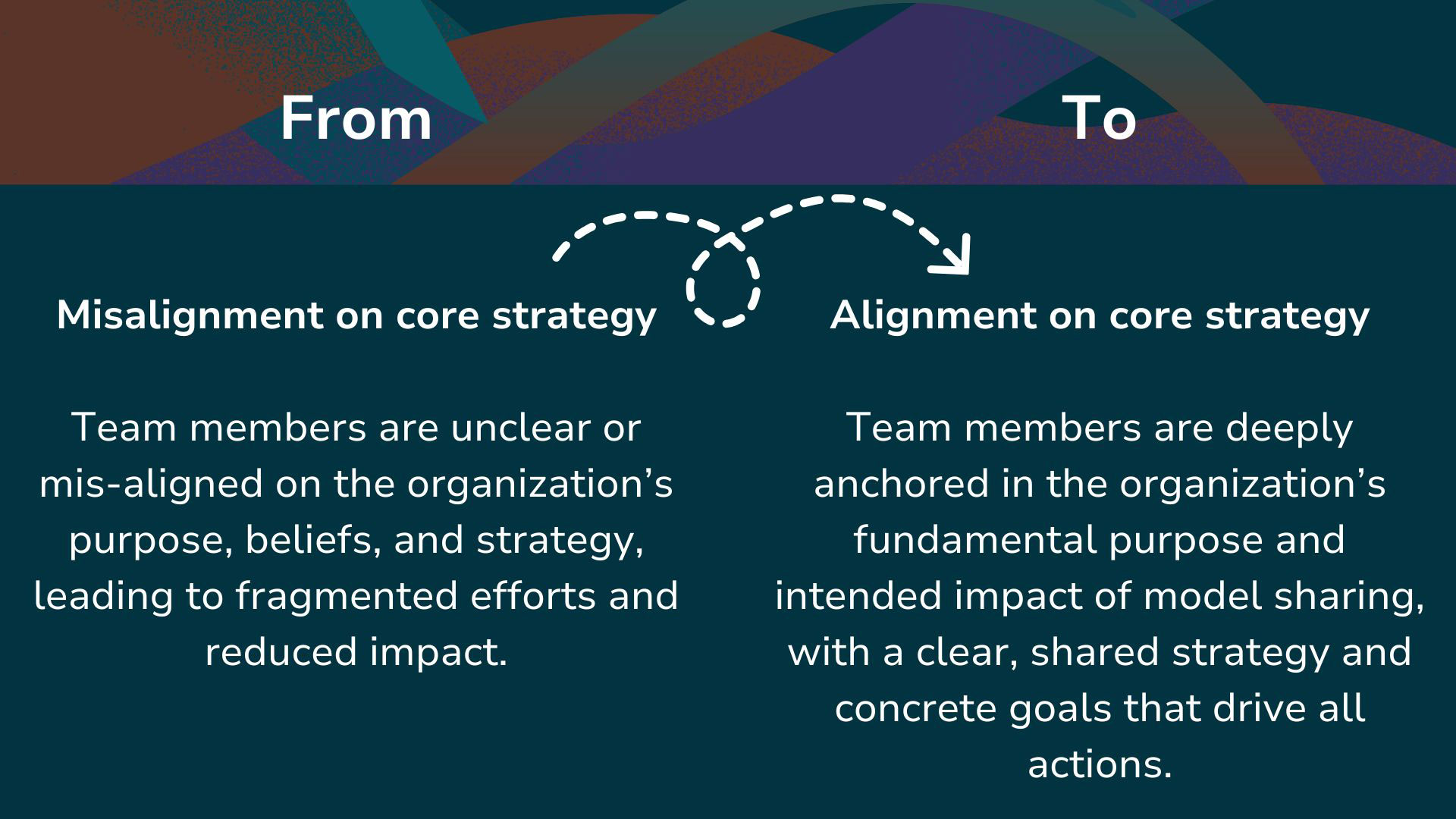

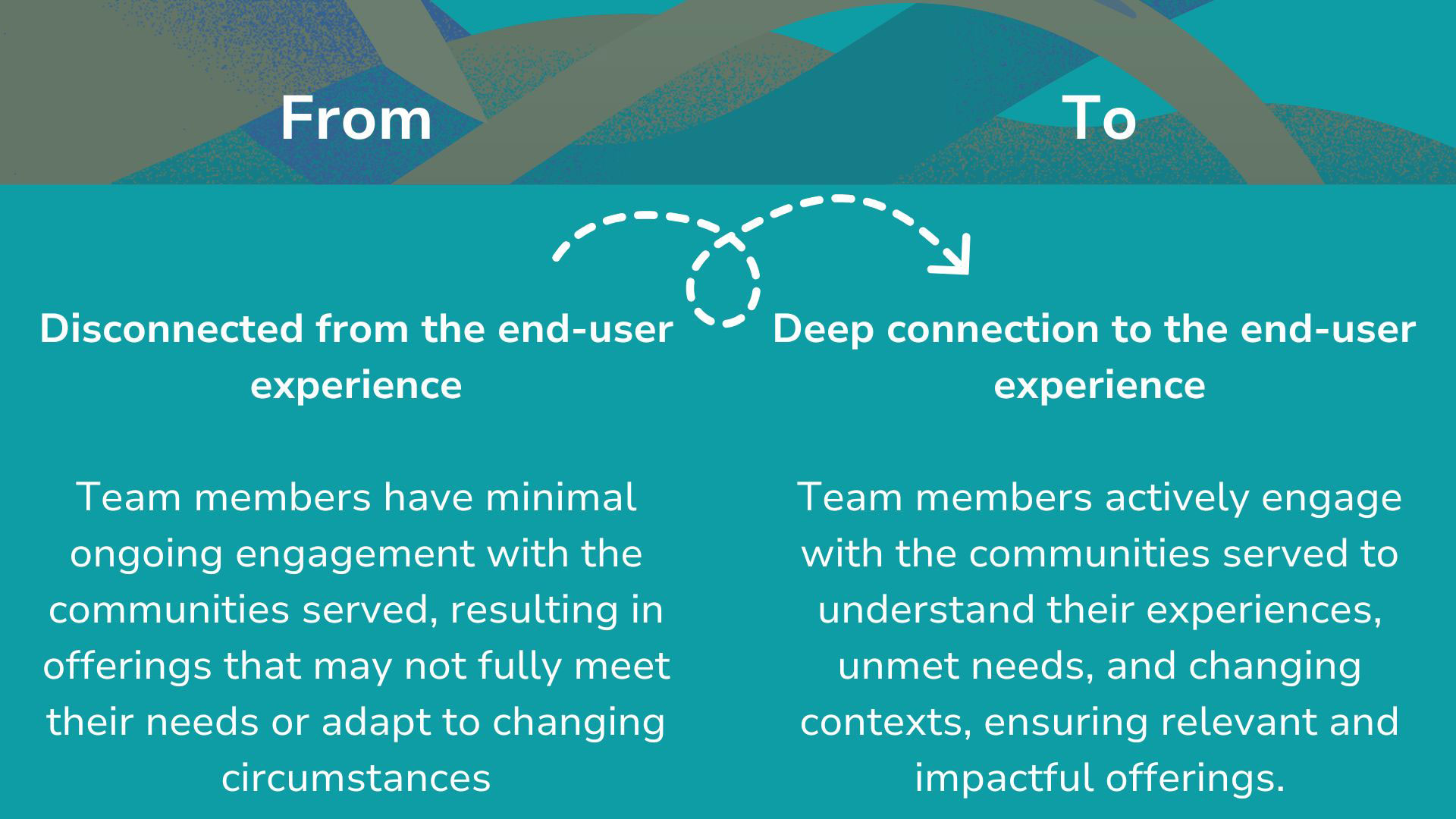

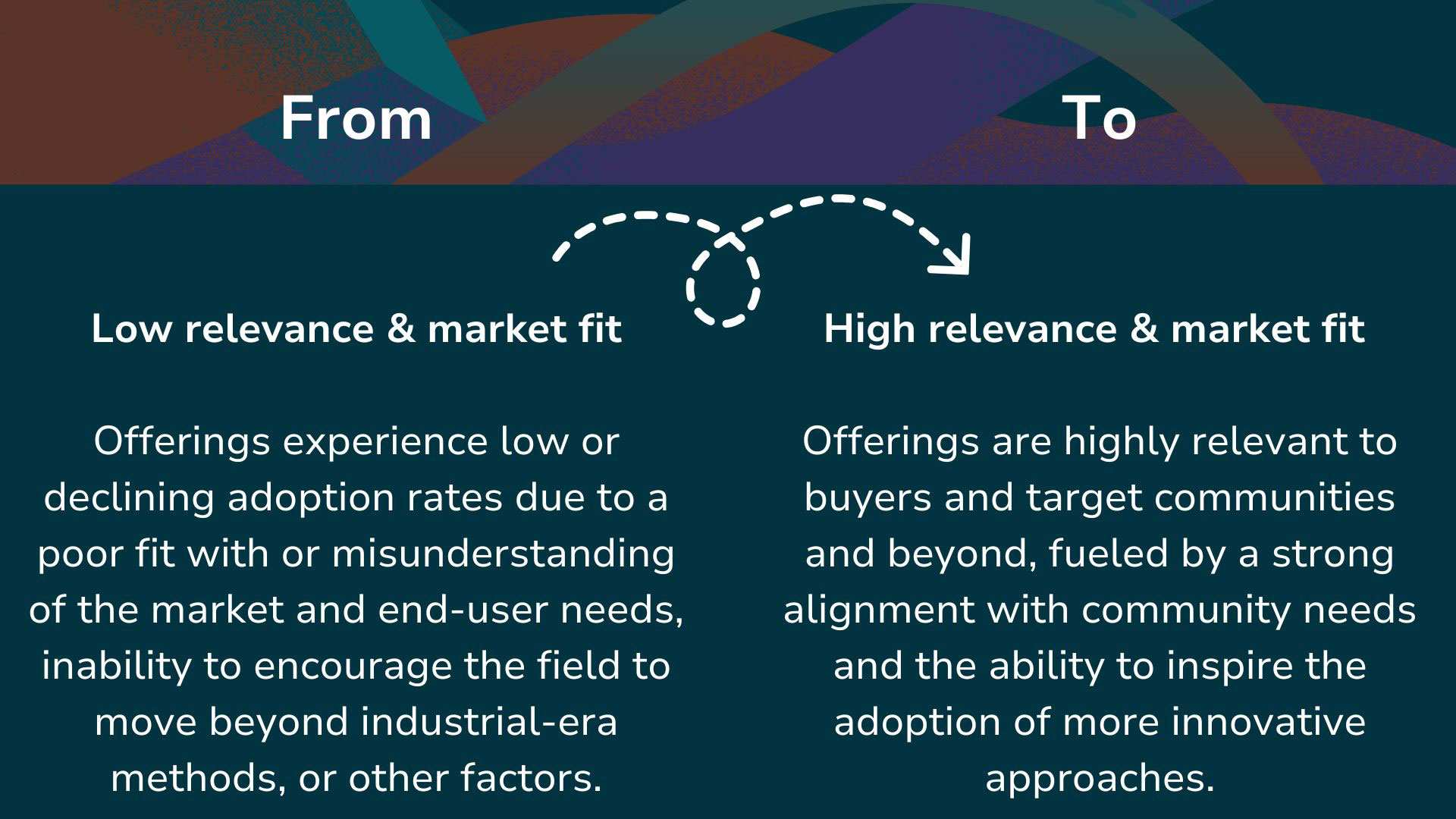

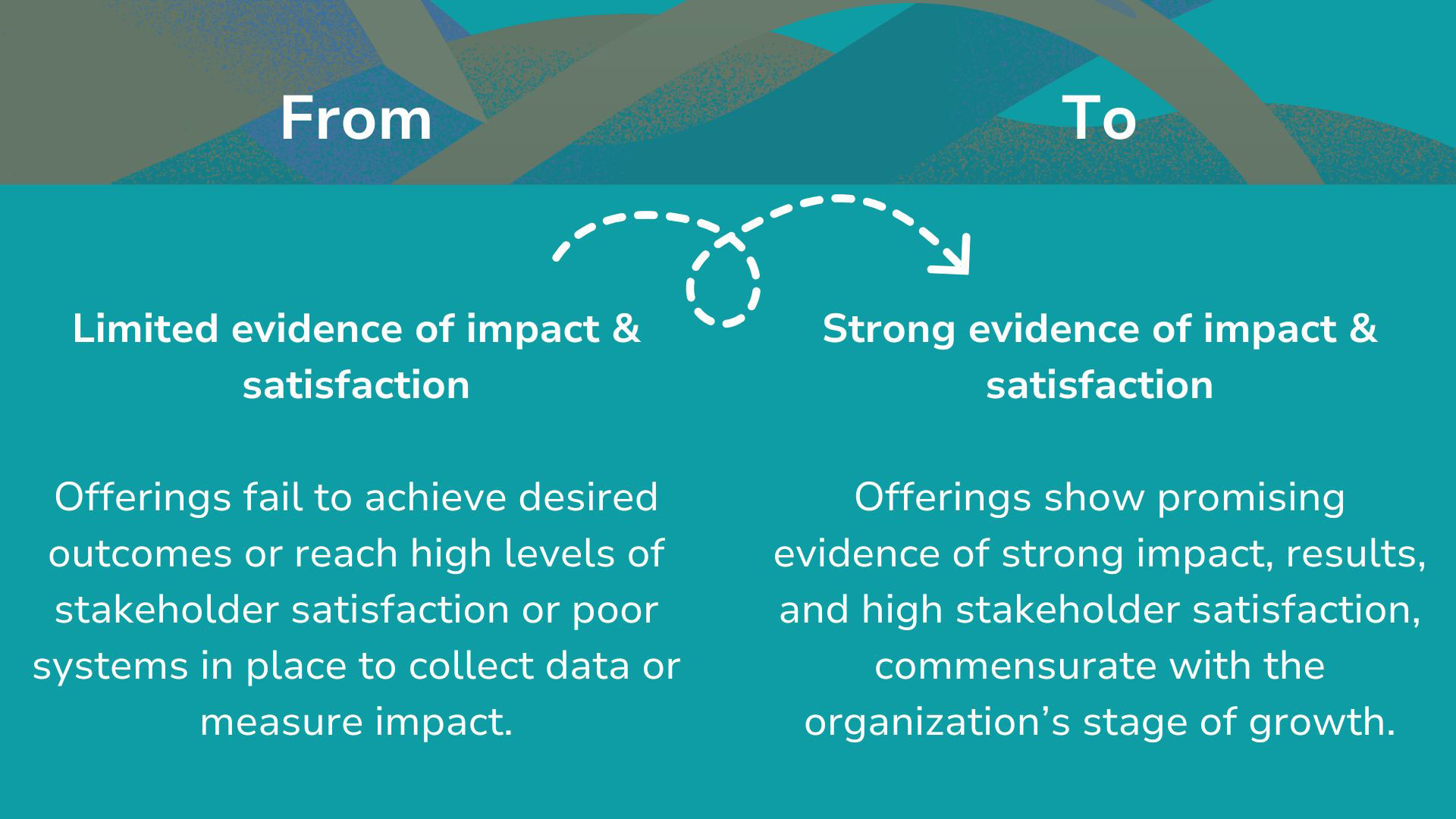

Explore the essential shifts model sharers are making to align their strategies, grow sustainably, and achieve long-term financial health. These 11 shifts guide organizations through the transformation needed to balance impact with financial sustainability. Use the gallery below to click through each shift and see where your organization stands on its journey toward sustainability.